puerto rico tax incentive program

2019 also known as the Puerto Rico Incentives Code PR-IC was created to update and combine within one piece of legislation a number of these incentives programs while adding even more. COMMONWEALTH OF PUERTO RICO DEPARTMENT OF THE TREASURY PO BOX 9022501 SAN JUAN PR 00902-2501 INCOME TAX RETURN FOR EXEMPT BUSINESSES UNDER THE PUERTO.

How To Speak Your Mind Without Making Someone Else Wrong Mindfulness Someone Elses Wrong

The Tax Incentives Office provides assistance to the Economic Development Bank of Puerto Rico in evaluating the loan applications for the development of tourism activities.

. The Young Entrepreneurs tax incentive was formerly known as Act 135. The Young Entrepreneurs tax incentive is open to any Puerto Rico resident between the ages of 16 and 35. One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the.

The Pros of Puerto Ricos Tax Incentives. Return must be filed January 5 - February 28 2018 at participating offices to qualify. Classifies the incentives according to strategic sectors and economic activities.

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes. For the decree to become effective the applicant is required to pay a mandatory filling fee equivalent of 1 of the Production Expenses of Puerto Rico up to a maximum rate of two. Under the Puerto Rico Incentives Programs.

If you want to get your income taxes to zero or to get. A Puerto Rican corporation thats engaged in certain types of service businesses only pays Puerto Rican tax of 4. The Puerto Rico Incentives Code recognizes the importance of direct foreign investment and places the Commonwealth on par with the most competitive global.

The short summary is that if you move to Puerto Rico and actually become a bona fide resident and earn your income from Puerto Rico then you no longer owe federal income. In order to promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes. In agreement with the economic.

Adds all the laws and incentives programs under one law. Bona fide residents of Puerto Rico enjoy a number of benefits for the Puerto Rico-sourced income that they receive a 100 tax exemption from Puerto Rico income taxes on. Local government has legislated a series of.

Thousands of Americans have already moved to the US-owned Caribbean island under the program to take advantage of Act 60s tax benefits with Puerto Ricos stunning. Puerto Rico has created an aggressive tax incentive program to connect with the global economy to establish an ever-growing array of service industries and to establish as an international.

Calculate Payments With Ease Mortgage Calculator Mortgage Loan Calculator Mortgage Amortization Calculator

Act 27 Puerto Rico Tax Incentives Film Industry Production

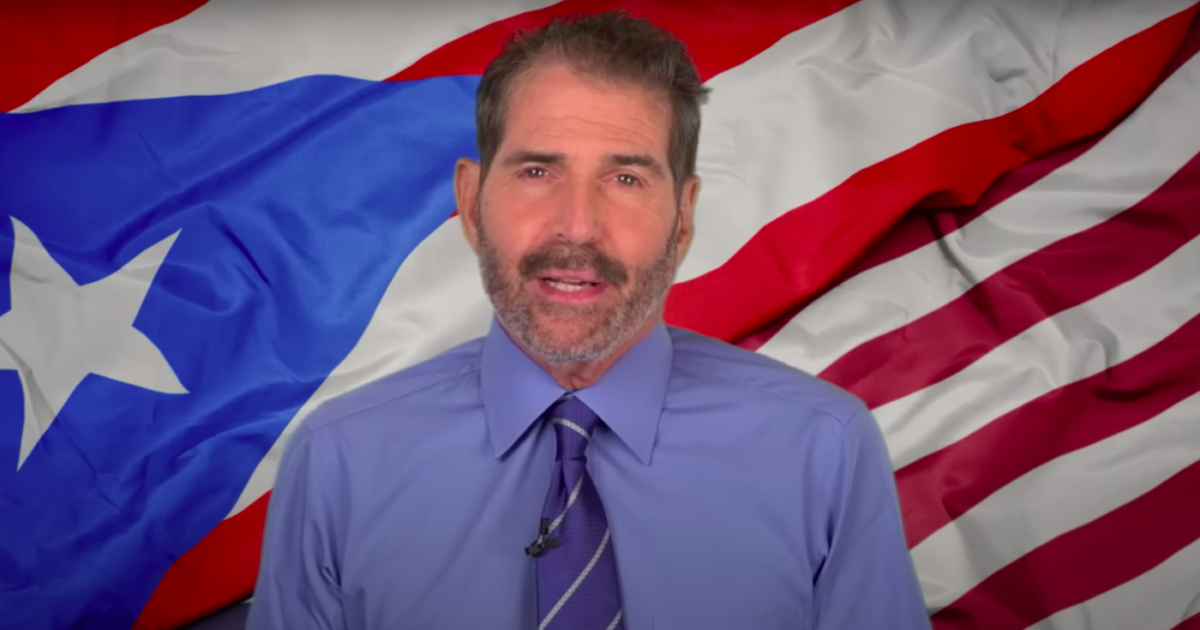

The Easy Way To Avoid Federal Income Tax Move To Puerto Rico

Puerto Rico Act 60 How You Can Lower Your Federal And State Tax Rates Under The Resident Tax Incentive Code Anchin Block Anchin Llp

Cool Changbaishan Map Map Tours Nature Reserve

Taxes And Fees Paying Financial Charge Obligatory Payment Calculating Personal Income Tax Doing Your Taxes Tax Credit Metaphors Ve Income Tax Tax Income

Pin On Actividades En Puerto Rico

Pin On Family Economic Security

How Puerto Rico S Act 60 Tax Incentives Can Benefit You Relocate To Puerto Rico With Act 60 20 22

Impact Investing Theories Of Change Theory Of Change Investing Theories

Move To Puerto Rico 7 Easy Steps Youtube Puerto Rico Living In Puerto Rico Puerto

Cares Act A Lifeboat For Puerto Rico Insights Dla Piper Global Law Firm

Federal Response Getting Puerto Rico Back On Its Feet The Epoch Times Newspaper Editorialdesign 신문 디자인 레이아웃 신문

Infographic Design Map Tax Haven Infographic

Puerto Rico Act 60 How You Can Lower Your Federal And State Tax Rates Under The Resident Tax Incentive Code Anchin Block Anchin Llp

Gst Registration In Delhi Tax Return Filing Agents In Delhi Income Tax Advisers In Delhi Income Tax Income Tax Return Tax Return

Sudahkah Mengenal Inflasi Invisible Hand Yang Selalu Mengurangi Nilai Uang Yang Anda Miliki Bahkan Ketika Anda Men Tax Refund Restaurant Gift Cards Tax Debt

Input Tax Credit Under Gst Proper Manner Of Utilisation With Example Tax Credits Legal Services Reconciliation